Real Protection for Real Renters: How Amenify’s Resident Protection Plan Covers What Insurance Doesn’t

Real Protection for Real Life: The Amenify Resident Protection Plan

Renters' insurance covers fires, floods, and theft. That’s great, for the once-in-a-blue-moon disasters.

But what about the everyday, real-life stuff renters actually deal with? Spilled wine on the carpet. Locking yourself out. Clogged disposal. Missed maintenance appointment. These are the things that show up on your lease ledger and rarely get covered.

The Amenify Resident Protection Plan was built for that reality.

This is not renters’ insurance. It is a functional reimbursement plan that will help residents offset common charge costs and will give operators a more professional and streamlined method for dealing with costs associated with their damage.

What does the Amenify Protection Plan Cover?

| Coverage | Renters Insurance | Amenify Protection Plan |

|---|---|---|

| Fire, theft, major water damage | ✓ | ✕ |

| Property management charges (e.g., lockouts, fees) | ✕ | ✓ |

| Minor accidental damage (e.g., wall holes, clogs) | ✕ | ✓ |

| Personal liability protection | ✓ | ✕ |

Here’s the breakdown of coverage:

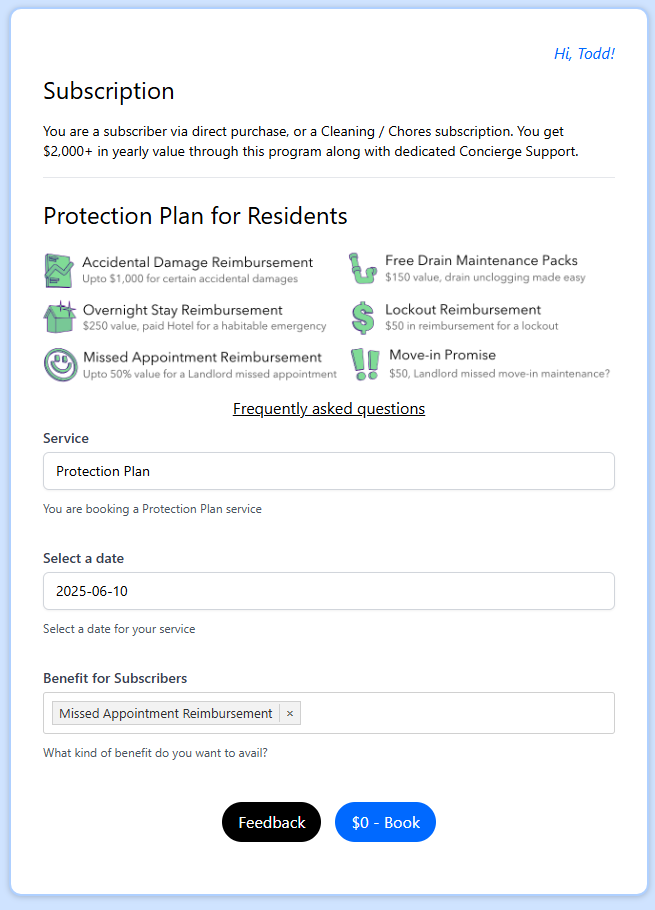

Accidental Damage Reimbursement Up to $1,000 annually, capped at $250 per quarter. Covers things like: Carpet stains, Wall holes, Disposal jams, Blinds, fixtures, and more

Key or Fob Replacement - up to $50 each incident

Lockout Fee Reimbursement - up to $50 each incident

Missed Maintenance Appointment Fees - up to $50 each incident

Overnight Stay Reimbursement - up to $150 for temporary housing after a displacement

Free Drain Snake Kit - 1-day (shipping upon request)

Total value? Up to $2,000/year. Monthly cost? $8.99 (or $9.99 with Amenify Bundle)

How Amenify’s Resident Protection Plan Works?

It was meant to be easy and fast, because who wants to file claims like it's 1995? The resident pays the property management fee (e.g., lockout, damage). Resident submits proof of payment to Amenify. Amenify bills and reimburses money directly to the requested bank account for the resident.

A couple of things to note:

If the plan begins sooner than the lease, claims are eligible immediately.

If the plan is added to an existing lease, there is a 15-day waiting period.

Claims must be made while the resident is still a tenant—no reimbursement post-move-out.

Why Does It Matter For Residents?

This plan picks up where renters' insurance leaves off. No waiting for a catastrophe. No calling an underwriter. No long forms. You handle an issue, pay the fee, and get reimbursed. It's immediate, clear, and actually useful.

It provides peace of mind for real-life renting.

Why Does It Work For Operators?

Let’s face it: Property management fees can be a real pain point. Lockout fees, missed maintenance fees, and disputes over damage can all create friction. Residents complain, dispute charges, and escalate to corporate. You end up wasting time, money, and occasionally, branch reputation.

With the Amenify Resident Protection Plan:

You keep your charges.

Residents get reimbursed, without complaint.

Disputes go down.

Compliance goes up.

Resident satisfaction improves.

It’s a win-win that also drives adoption of other value-added services. And it takes zero lift from your team. Amenify handles the admin, support, and payouts.